how to claim utah solar tax credit

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. Heres what the line 14 worksheet looks like for Mr.

![]()

Utah Solar Tax Credits Blue Raven Solar

If you dont qualify for the entire tax credit in the first year you can roll over the amount over 5 years.

. The solar ITC in Utah isnt limited to one photovoltaic system either. Complete IRS Form 5695. So the big question is how much can you save with the Utah solar ITC.

Write the code and amount of each apportionable nonrefundable credit in Part 3. As an example well say 20000. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects capped at 1600 whichever is less.

Application fees are non-refundable. Find out how much your solar credit is worth. Utah Sales Tax Exemptions.

If audited provide your TC-40E. If your tax liability equals less than your tax credit subtract. Ad Enter Your Zip Code - Get Qualified Instantly.

If youre looking for yet another reason to go solar in Utah the state offers tax exemptions on PV systems that have a 2MW capacity or greater. The federal tax credit falls to 22 at the end of 2022. The Utah residential solar tax credit is also phasing down.

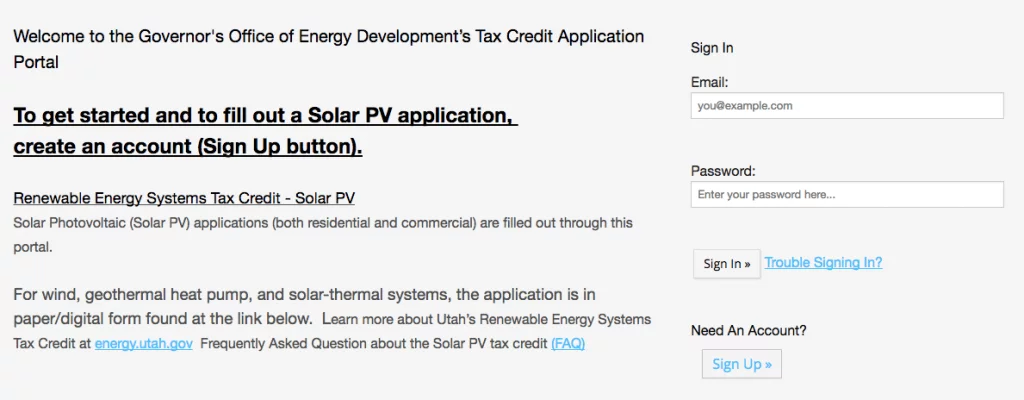

Utah you can claim 25 percent of your photovoltaic costs up to 1600 if you install a solar energy system by then end of 2020. Below you will find instructions for both. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp.

Solar Tax Credit Extension. Install a solar energy system. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply.

Under the most recent extension rates will decrease to 22 in 2023. In accordance with Utah Code 63M-4-401 the Utah Governors Office of Energy Development OED charges a 15 application fee. Receive and save your TC-40E.

See more detail about how to calculate it here. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. 10000 system cost x 026 26 credit 2600 credit amount.

Then subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. You can claim the state credit for more than one system as long as each one is installed on a residential unit that you own or use. Opt for a system without.

You will want to make sure of this up front because many companies. You can claim 25 percent of your total equipment and installation costs up to 800. Claim the Renewable Residential Energy System Credit.

File for the TC-40e form you request this then keep the. In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up to 2000. How To Claim Your Tax Credit.

Utah Governors Office of Energy Development. The ITC has since been revisited several times most recently in December of 2020 when Congress extended the ITC at the rate of 26 through the end of 2022. Enter the full amount you paid to have your solar system installed in line 1.

This is the total amount you can claim for the solar tax credit. Do not send this form with your return. Claim the credit on your TC-40a form submit with your state taxes.

For each qualifying system you can claim up to 25 percent of the costs with a maximum claim of. The 3 steps to claiming the solar tax credit. Paying the fee does not guarantee that you will be approved for the tax credit.

This includes costs associated with the materials and installation of your new solar system. Exampleson who has an initial tax liability listed on line 1 below of 3820 this year and can claim no other tax credits. Download your instructions form here.

To claim the ITC you will need to file under IRS From 5695. May I claim a tax credit if it came with solar PV already installed. In order to claim the Solar Tax Credit you must own not lease the solar energy system you are installing.

If you live there for three months a year for instance you can only claim 25 of the credit. This is 26 off the entire cost of the system including equipment labor and permitting. If the system cost 10000 the 26 credit would be 2600 and you could claim 25 of that or 650.

Check 2022 Top Rated Solar Incentives in Utah. To claim your solar tax credit in Utah you need to do 2 things. Add to Schedule 3 and Form 1040.

Keep the form and all related documents with your records to provide the Tax Commission upon request. 1 Claim the credit on your TC-40a form submit with your state taxes. For the purposes of this article lets assume the gross cost of your solar system is 25000.

Learn more and apply here. Add the amounts and carry the total to TC-40 line 24. To claim your solar tax credit in Utah you will need to do 2 things.

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax creditin other words you may claim the credit in 2021. The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax credit for 75 of new state tax revenues including state corporate sales and withholding taxes over the life of the project or 20 years whichever is less. Thats in addition to the 26 percent federal tax credit for solar not a bad deal for a system that can save you thousands each year on.

You will not receive your TC-40E tax form until the fee has been paid. Determine if youre eligible. It was originally set to decrease to 22 in 2021.

Steel windows 13 steel windows windows steel doors and. Homeowners can take advantage of the Federal Solar Tax Credit to get a tax break while positioning themselves to save on their energy bill. Fees must be paid by credit card.

Enter Your Zip See If You Qualify. 2 File for the TC-40e form you request this and then keep the record. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

Check Rebates Incentives. Attach TC-40A to your Utah return. There are three main steps youll need to take in order to benefit from the ITC.

Create an account with the Governors Office of Energy Development OED Complete a solar PV application.

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

When Does The Federal Solar Tax Credit Expire Iws

Federal Solar Tax Credit Savings 2020 Vs 2021 Energysage

Utah Solar Tax Credits Blue Raven Solar

The Best Solar Companies In Utah Top Solar Installers In Ut 2021

Utah Solar Tax Credits Blue Raven Solar

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Understanding The Utah Solar Tax Credit Ion Solar

How Does The Solar Tax Credit Work In Idaho Iws

Solar Incentives In Utah Utah Energy Hub

How Does The Utah Solar Tax Credit Work Iws

Utah Solar Panel Installations 2022 Pricing Savings Energysage

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Utah Solar Incentives Creative Energies Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage